The UK rental market would have been undergoing some changes in 2025. After years of rapid increases, the rents are starting to stabilize, supply is starting to get better, and new regulations are rearranging relations between landlords and tenants. In order to make ends meet, landlords must be able to apply any changes, and tenants must be able to negotiate a fair deal. It is essential to understand the latest market trends.

Cooling Rent Growth but Record Highs Remain

Average rents across the UK are setting records nowadays, although the growth seems to be slowing down in speed. As per the reports, the highest average monthly rentals are around £1,287 across the UK, whereas London records an amount close to £2,700 per month.

However, there has been a statured elongation of growth, less than 3% per annum as of now, and the last time we observed such statistics might be since 2021, witnessing push in terms of affordability. The demand, on the contrary, has been very strong, almost 12 renters on a single property! Before the pandemic, it was only half of this. This means that competition is still hard for the tenants, and for landlords, pricing competitively is paramount to sustain long void periods.

Supply Is Improving — But Still Short

For the renter, a new bit of information: the availability of homes has increased by 17 percent from last year. However, rental stock remains down 20 percent from pre-pandemic levels; the market is yet to ease.

By securing investment in buy-to-let, supply has been eased to a degree, and there is capital lettor mortgage lending on the rise. This might suggest a return of confidence in the sector, but in reality, affordability barriers remain for a sizable number of households.

Regional Variations in Rental Growth

While London and other high-cost cities are down on growth, and the growth of prices in the cheaper regions than elsewhere are higher than in miserable cities.

- North-East rents are up 5.3% year by year.

- Rochdale (+11.9%) and Blackburn (+10%) have become rental hotspots.

- Some areas are finding it hard to charge higher rents and are even seeing prices fall; for example, Leeds (-1.5%).

For the Landlords, it means opportunities otherwise outside the purview of the traditional big-city markets. For tenants, this means regional cities may furnish better value and more room.

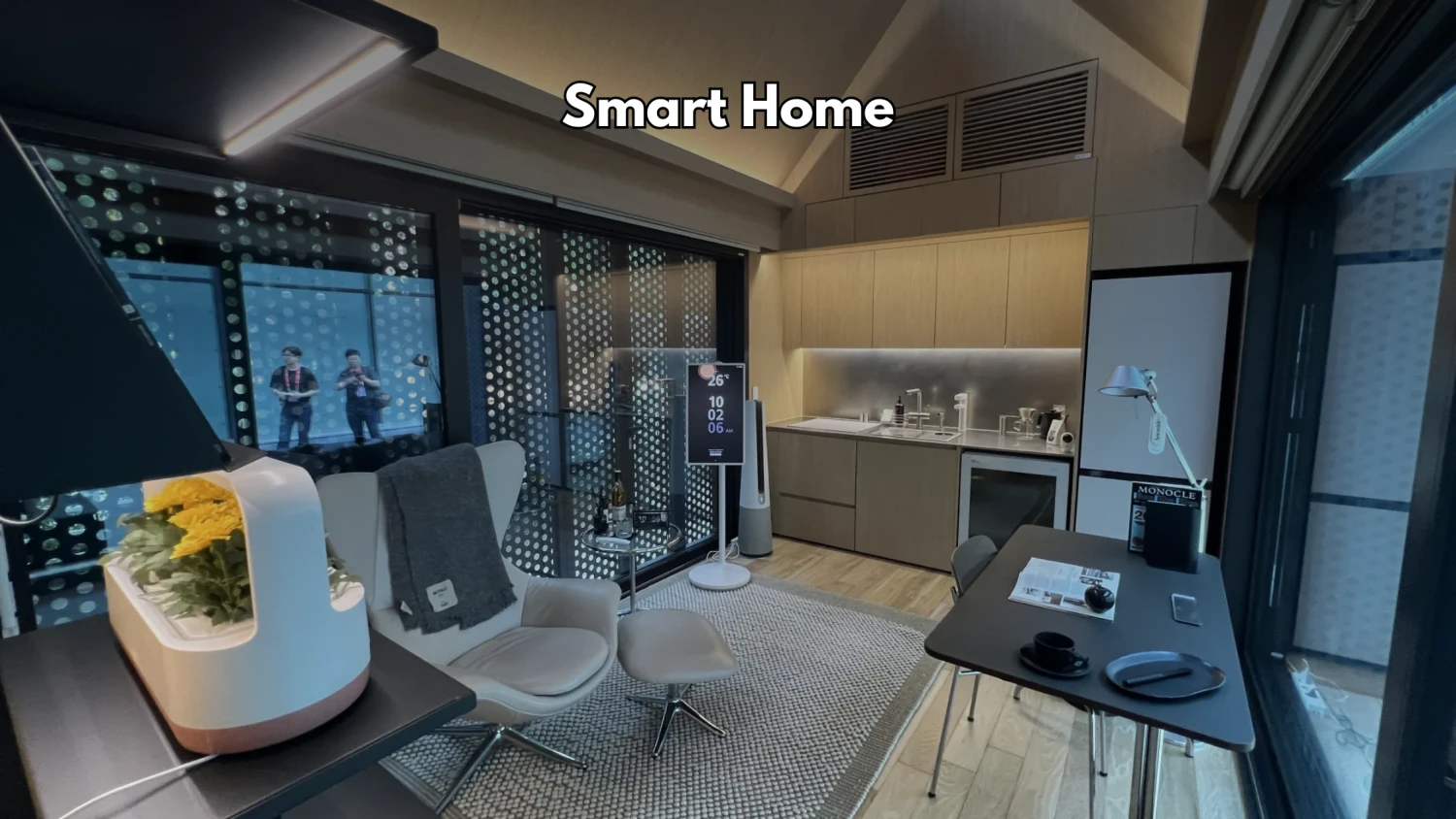

Shifting Tenant Expectations

Tenants in 2025 are no longer price-chasers. Their priorities are changing.

- Sustainability: Good Energy Performance Certificates are in demand, while energy costs stay high.

- Flexibility: Remote working has made short-term leases or even signs on for flex tenure agreements much more favored.

- Home Office: Either having a spare room or a flexible layout has become an essential requirement for many renters.

- Pet-Friendliness: The pet-willing-to-be-accepted-by-landlords syndrome is gaining traction among tenants.

- Connectivity & Amenities: High-speed internet, efficient transport links, and access to the open green are top considerations.

Such trends, if heeds, would see these landlords secured with long-term, trustworthy tenants.

Legislative Changes Landlords Must Watch

Among the most transformative things this year is the Renters' Rights Bill. The reforms include:

- The abolition of Section 21 no-fault evictions.

- Notices of rent increase limited to one a year.

- More protections for tenants.

Improvement in the energy efficiency standards is taking place. Properties will likely be needed to achieve EPC rating of C or above in 2028, with average upgrade costs estimated at £8,000 per property.

For landlords, these standards are now compulsory. Those that plan early can save costs in the long term and maintain property values.

What This Means for Tenant

In favour of vendors, with rent growth cooling, rewards still have to be offered. Tenants should:

- Stay open to regional markets where the level of affordability is better.

- Seek such landlords who would help them with flexible lease terms.

- Give priority to energy-efficient homes to save on running costs.

What This Means for Landlords

2025 is a treasure trove of opportunities for innovative landlords despite challenges within the market. Some of the key ones are:

- Affordable growth locations whereby yields are strong.

- Competitive pricing so as to minimise voids periods.

- Investment into compliance for EPC and legal standards.

- Sustainability upgrades, consideration of pet policies, and all the way to tenant appeal with amenities.

Conclusion

The UK rental market in 2025 offers a cooling pace of rent increments, changing demand patterns from tenants, and sweeping regulatory reform. It is a still-competitive but more balanced market to traverse for tenants. For landlords, it is a year of adaptation and compliance, tenant-centric reforms, plus complementary, smart investment strategies.

Those ahead of the schedule shall find success in this changing landscape.