Being increasingly volatile, the rental market now subjects the UK landlord to an increase in costs, relatively tight regulations, and changing tenant expectations. Rent-setting, if done properly, is the most basic way to stay profitable. In other words, one can vacate periods for being too high or rather leave profits on the table for being too low.

Getting the balance right is key to maximising letting income in 2025. Here's how landlords can strategically approach rent-setting while enhancing profits for the long term.

How the Right Rent Matters

The rent you charge is the foundation for the yield from your renting, or the percentage return upon the investment made on your property. Being the first of all profits, it also creates demand from the tenants and the value of the property.

An overpriced property would be vacant for a longer time and will face higher turnover and resistance from tenants; whereas lower rents result into lower yields and thus missed income opportunities.

Research-based competitive rents attract tenants swiftly thereby ensuring maximum occupancy and steady cash flow.

1. Research Local Market Conditions

Rental values greatly differ between regions, cities, or oh-so-gentrified neighborhoods.

Keep an eye on trends of tenant demand — those areas next to universities, transport hubs, or where jobs happen usually charge higher rents

Stay informed about fluctuations in the economy, such as interest rates or fuel costs, so that they will appear in the prospective tenant's budget.

Tip: Utilize online rental valuation tools or hire professional lettings appraisers to back your assumptions.

2. Make Rent Fit Your Target Tenant

Your ideal tenant has a say in rent potential

- Young professionals pay a premium for modern finishes, high-speed internet, and convenient transport links.

- Families want larger layouts, good schools, and safe neighborhoods.

- Students put a premium on affordable rent for cheap options and proximity to campus.

If you set your rent and property features based on tenant expectations, you will be able to justify higher rents while still keeping demand high.

3. Minimising void periods

Independent of a system, an empty property eats away at profits. To limit downtime:

- Market the property before the current tenancy comes to an end

- Flexibility on move-in dates can be a great option

- Give renewals incentives, such as a tiny freeze on rents or an upgrade on appliances

To put it straight: a somewhat lower rent coupled with no voids can prove much more rewarding than one that looks high on paper but leads to months of unending vacancy.

4. Value Addition Through Upgrading

Should the masseurs of high rent be stuck on the house, then it must stand out. Cost-effective enhancements, among others, include:

Kitchen and bathroom upgrades

Installation of energy-efficient heating systems

Part-furnished or fully-furnished options

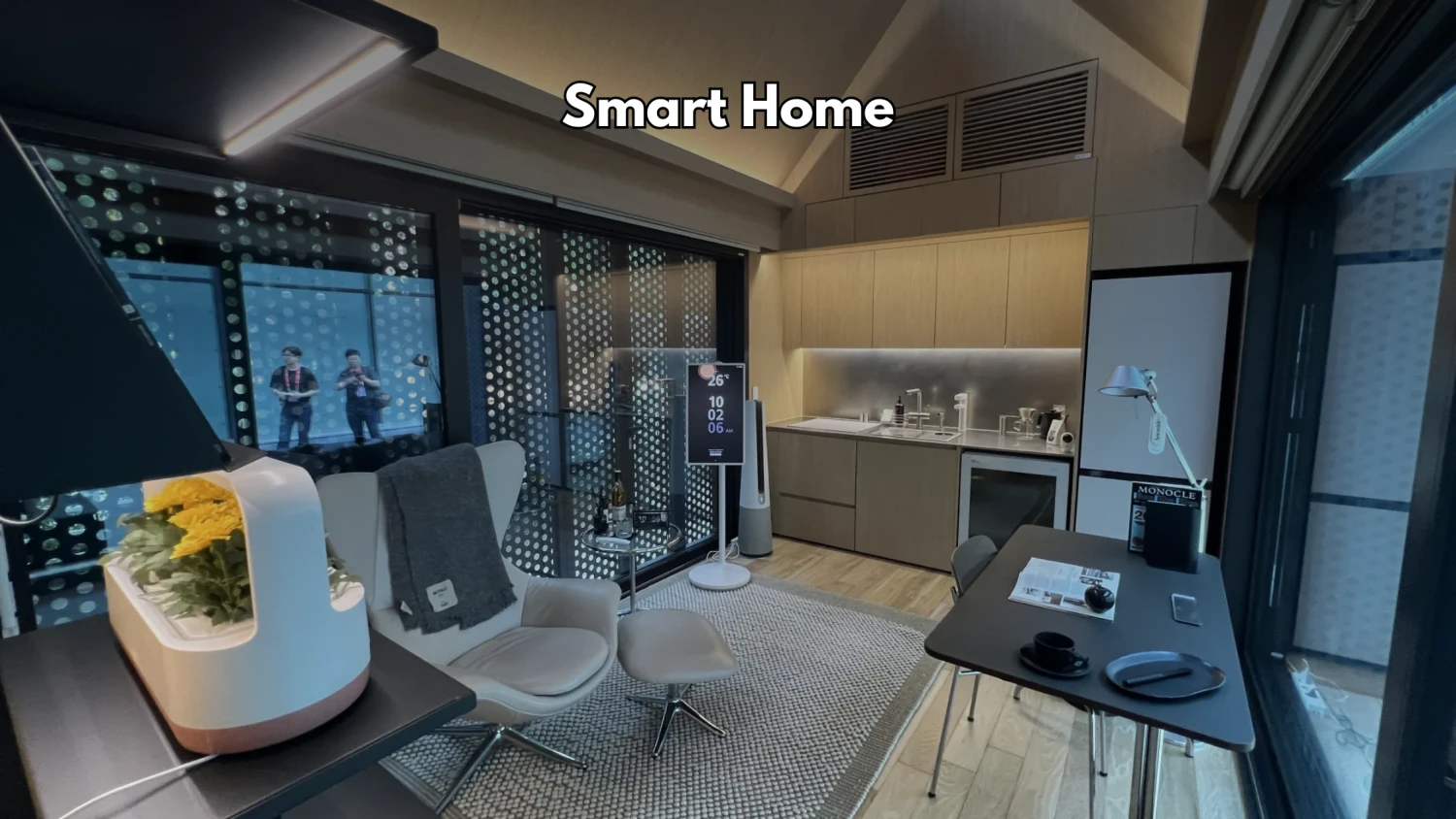

Other pleasant touches that benefit tenants from smart thermostats down to built-in wardrobes and storage

The slight things matter-they can add to appeal and demand a higher rent, all the while assisting retention of tenants.

5. Think Energy Efficiency

The market is leaning toward tenants concerned with energy bills and sustainability. Properties that have high EPC ratings generally pull higher rents and lease faster.

Simple sprinkles of insulation, double glazing, or LED lighting can juice attractiveness — and future-proof your property to some extent against any rule changes that may come.

6. Review Rent Annually

Adjustment of rent by many landlords is at variance with the market trend. To avoid falling behind:

- Set a rent for the property according to other similar listings once a year.

- Take into account inflation, local demand, and comments from tenants

- Introduction increases gradually and obviously in order to maintain a positive relationship with your good tenants.

Perform regular reviews to make sure that you stay competitive and do not lose good tenants.

7. Working With Letting Agent

If you're unsure about pricing or if you want to sit back while minimising your payout, the professional letting agent will give you:

- Accurate rental valuations

- Good exposure of your property

- Tenant section

- Keep you compliant with changing requirements for landlords

The right agent can get you top rent with the least amount of risk.

Conclusion

For UK landlords, setting the right rent is a balancing act between income and demand. With local market research, an approach tailored to tenant needs, smart upgrades, and a regular review of rent, letting income can be maximised in 2025 and beyond.

Keep in mind that profitability is not just charging more — it is about keeping your property desirable, occupied, and compliant. The right approach yields strong and sustainable returns in a highly competitive rental market.